Calculating the weighted average discount rate for leases is a critical aspect of lease accounting. This rate is used to determine the present value of future lease payments, which is necessary for recognizing the lease liability and right-of-use asset on the balance sheet.

The weighted average discount rate is calculated based on the implicit interest rate in the lease, which is the rate that would have been charged had the same lessee and lessor entered into a similar transaction in a non-lease context. In situations where an implicit interest rate is not provided in the lease agreement, it is determined using a risk-free rate and an appropriate risk premium.

To further understand the calculation process and its significance in lease accounting, let's delve into the detailed steps and explore real-world examples in the subsequent sections.

How to Calculate Weighted Average Discount Rate for Leases

To determine the weighted average discount rate for leases, consider the following key points:

- Identify Implicit Interest Rate

- Assess Risk-Free Rate

- Apply Risk Premium

- Calculate Discount Rate

- Consider Lease Term

- Review Periodic Payments

By understanding these aspects, you can accurately calculate the weighted average discount rate and ensure proper lease accounting.

Identify Implicit Interest Rate

The implicit interest rate is a crucial element in calculating the weighted average discount rate for leases. It represents the interest rate that would have been charged if the lessee and lessor had entered into a similar non-lease transaction. This rate is not always explicitly stated in the lease agreement, so it must be determined using specific methods.

To identify the implicit interest rate, the following steps can be taken:

- Review Lease Agreement: Examine the lease agreement thoroughly to determine if the implicit interest rate is explicitly stated. It may be labeled as the "interest rate," "discount rate," or a similar term.

- Calculate Using Present Value of Lease Payments: If the implicit interest rate is not explicitly stated, it can be calculated using the present value of lease payments. This method involves determining the present value of all future lease payments using a range of potential discount rates. The implicit interest rate is the discount rate that results in the present value of lease payments being equal to the lease liability.

- Consult Market Data: Another approach to identifying the implicit interest rate is to refer to market data. This involves researching similar lease transactions in the market and analyzing the interest rates associated with those leases. The implicit interest rate can be estimated based on this market data.

- Seek Professional Assistance: In complex lease arrangements or when the implicit interest rate is challenging to determine, it is advisable to consult with a qualified professional, such as a financial analyst or accountant. They can provide expert guidance in calculating the implicit interest rate accurately.

By following these steps, you can effectively identify the implicit interest rate, which is a critical component in determining the weighted average discount rate for leases.

Assess Risk-Free Rate

The risk-free rate is a crucial benchmark used in calculating the weighted average discount rate for leases. It represents the interest rate on a hypothetical loan with no risk of default. This rate is often associated with government bonds issued by countries with stable economies and low inflation.

- Identify Suitable Risk-Free Rate:

To assess the risk-free rate, it is essential to identify a suitable benchmark that reflects the currency and term of the lease. Commonly used risk-free rates include the yield on government bonds, such as U.S. Treasuries or UK Gilts.

- Consider Lease Term:

The term of the lease should be taken into account when selecting the risk-free rate. Longer-term leases may require a risk-free rate that reflects the longer duration of the loan.

- Analyze Market Conditions:

It is important to analyze current market conditions, including economic indicators and interest rate trends. This analysis helps in selecting an appropriate risk-free rate that is reflective of the prevailing economic environment.

- Refer to Published Sources:

Various financial institutions and data providers publish risk-free rates. These published rates can be used as a reference point when assessing the risk-free rate for lease calculations.

By carefully assessing the risk-free rate, you can ensure that the weighted average discount rate accurately reflects the risk-free component of the lease transaction.

Apply Risk Premium

The risk premium is an additional component added to the risk-free rate to account for the credit risk associated with the lessee. It compensates the lessor for the increased risk of non-payment by the lessee. The risk premium is typically determined based on the lessee's creditworthiness.

Here are the steps involved in applying the risk premium:

- Assess Lessee's Creditworthiness: Evaluate the lessee's financial health, payment history, and overall creditworthiness. This assessment can be based on financial statements, credit reports, and other relevant information.

- Determine Credit Risk Category: Assign the lessee to a specific credit risk category, such as low risk, medium risk, or high risk. This categorization helps in determining the appropriate risk premium.

- Refer to Market Data: Research market data and industry benchmarks to determine the typical risk premium applied to leases with similar credit risk profiles. This data can be obtained from market surveys, industry studies, or consultations with financial professionals.

- Consider Lease-Specific Factors: Take into account any lease-specific factors that may affect the risk premium. These factors may include the lease term, the type of asset being leased, and the presence of collateral or personal guarantees.

By carefully applying the risk premium, you can ensure that the weighted average discount rate accurately reflects the risk associated with the lease transaction.

The weighted average discount rate, which incorporates the risk-free rate and risk premium, is a crucial element in determining the present value of lease payments and recognizing the lease liability and right-of-use asset on the balance sheet.

Calculate Discount Rate

The weighted average discount rate is calculated by combining the risk-free rate and the risk premium, taking into account the lease term and periodic payments.

- Determine Risk-Free Rate and Risk Premium:

As discussed in the previous sections, the risk-free rate and risk premium are essential components of the weighted average discount rate. These rates should be carefully assessed and determined based on relevant factors.

- Calculate Discount Rate:

Once the risk-free rate and risk premium have been determined, the discount rate can be calculated using the following formula:

Discount Rate = Risk-Free Rate + Risk Premium

- Consider Lease Term:

The lease term is an important factor to consider when calculating the discount rate. Longer lease terms typically require a higher discount rate to reflect the increased risk and uncertainty over the extended period.

- Account for Periodic Payments:

The periodic payments specified in the lease agreement should be taken into account when calculating the discount rate. The discount rate is applied to these payments to determine their present value.

By following these steps and considering all relevant factors, you can accurately calculate the weighted average discount rate for leases, which is essential for lease accounting and financial reporting.

Consider Lease Term

The lease term is a crucial factor that impacts the calculation of the weighted average discount rate for leases. It influences the risk associated with the lease and the present value of lease payments.

- Longer Lease Terms Increase Risk:

As the lease term increases, the risk associated with the lease generally increases as well. This is because there is a greater likelihood of economic and market conditions changing over a longer period, potentially affecting the lessee's ability to make lease payments or the value of the leased asset.

- Higher Discount Rate for Longer Terms:

To account for the increased risk, a higher discount rate is typically applied to longer lease terms. This higher discount rate reduces the present value of lease payments, resulting in a lower lease liability and right-of-use asset.

- Shorter Lease Terms Reduce Risk:

Conversely, shorter lease terms generally pose less risk because of the reduced uncertainty over a shorter period. As a result, a lower discount rate may be appropriate for shorter lease terms.

- Consider Lease Renewal Options:

If the lease agreement includes renewal options, these options should be carefully evaluated when determining the lease term. Renewal options essentially extend the lease term, and therefore, the risk and discount rate should be assessed accordingly.

By considering the lease term and its impact on risk and the present value of lease payments, you can ensure that the weighted average discount rate accurately reflects the economic realities of the lease transaction.

Review Periodic Payments

The periodic payments specified in the lease agreement play a vital role in calculating the weighted average discount rate for leases. These payments are discounted using the discount rate to determine their present value.

- Fixed vs. Variable Payments:

Lease agreements may involve fixed payments, variable payments, or a combination of both. Fixed payments remain constant throughout the lease term, while variable payments may fluctuate based on factors such as inflation or market conditions.

- Discounting Fixed Payments:

For fixed payments, the discount rate is applied directly to each payment to calculate its present value. The present value of all fixed payments is then summed up to determine the total present value of the lease payments.

- Discounting Variable Payments:

Variable payments require a slightly different approach. The discount rate is applied to each payment's estimated future value to determine its present value. The present value of all variable payments is then summed up to calculate the total present value of the lease payments.

- Consider Payment Frequency:

The frequency of lease payments also affects the calculation. More frequent payments result in a lower present value compared to less frequent payments, assuming the same discount rate. This is because more frequent payments reduce the time value of money.

By carefully reviewing and analyzing the periodic payments in the lease agreement, you can accurately determine the present value of lease payments, which is a crucial component in calculating the weighted average discount rate.

FAQ

To provide further clarity on the calculation of the weighted average discount rate for leases, here are some frequently asked questions and their answers:

Question 1: What is the purpose of calculating the weighted average discount rate for leases?

Answer: The weighted average discount rate is used to determine the present value of future lease payments, which is necessary for recognizing the lease liability and right-of-use asset on the balance sheet. It helps in accurately portraying the lease transaction's financial impact.

Question 2: How do I identify the implicit interest rate in a lease agreement?

Answer: To identify the implicit interest rate, you can examine the lease agreement for an explicitly stated rate. If it is not provided, you can calculate it using the present value of lease payments or consult market data and seek professional assistance if needed.

Question 3: What is the risk-free rate, and how does it affect the discount rate?

Answer: The risk-free rate is a benchmark interest rate that represents the interest rate on a hypothetical loan with no risk of default. It serves as the foundation for determining the discount rate. The higher the risk-free rate, the higher the discount rate, and vice versa.

Question 4: How do I apply the risk premium to the discount rate?

Answer: The risk premium is added to the risk-free rate to account for the credit risk associated with the lessee. It is determined based on the lessee's creditworthiness and lease-specific factors. A higher risk premium results in a higher discount rate.

Question 5: How does the lease term impact the calculation of the discount rate?

Answer: The lease term is a crucial factor as it influences the risk associated with the lease. Longer lease terms generally lead to higher discount rates due to increased uncertainty. Conversely, shorter lease terms may warrant lower discount rates.

Question 6: How do I account for periodic payments in the discount rate calculation?

Answer: Periodic lease payments are discounted using the discount rate to determine their present value. For fixed payments, the discount rate is directly applied. For variable payments, the estimated future value of each payment is discounted. The present value of all payments is then summed up to calculate the total present value of the lease payments.

Remember that the calculation of the weighted average discount rate for leases can be complex and requires careful consideration of various factors. Consulting with a qualified professional is recommended for complex lease arrangements or when there is uncertainty in determining the appropriate discount rate.

To further enhance your understanding of this topic, explore the additional tips and insights provided in the following section.

Tips

To further enhance your understanding and proficiency in calculating the weighted average discount rate for leases, consider the following practical tips:

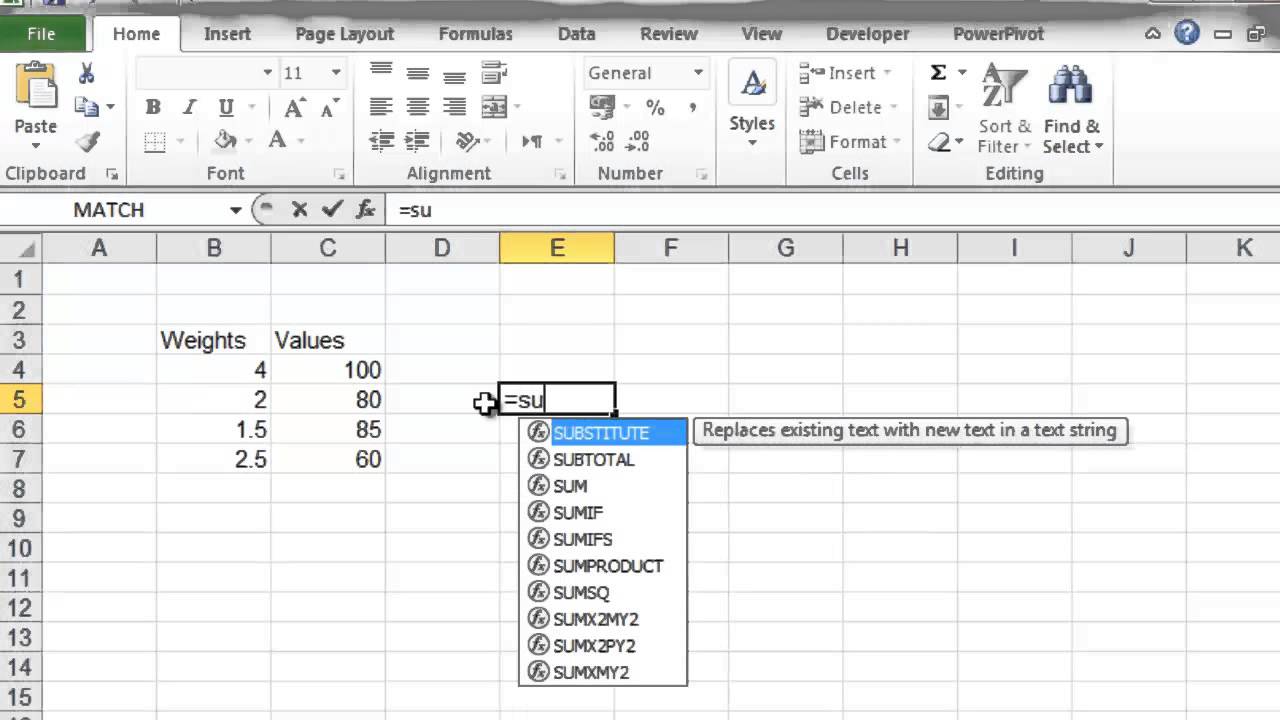

Tip 1: Utilize Technology:を活用する: Take advantage of available technology and software tools designed specifically for lease accounting. These tools can streamline the calculation process, reduce manual errors, and ensure accuracy.

Tip 2: Consult Industry Resources: Seek out and utilize industry resources, such as accounting standards, guidelines, and publications, to stay updated on the latest developments and best practices in lease accounting.

Tip 3: Consider Economic Conditions: When assessing the risk-free rate and risk premium, take into account the current economic conditions and market trends. These factors can significantly impact the appropriate discount rate.

Tip 4: Document Assumptions and Calculations: Thoroughly document the assumptions made and the calculations performed during the discount rate determination process. This documentation serves as a valuable record for future reference and audit purposes.

Remember, the calculation of the weighted average discount rate for leases requires careful analysis and professional judgment. By following these tips and adhering to relevant accounting standards, you can ensure accurate and reliable lease accounting practices.

In the concluding section, we will summarize the key takeaways and emphasize the significance of accurate discount rate calculation in lease accounting.

Conclusion

In summary, calculating the weighted average discount rate for leases is a critical aspect of lease accounting, enabling the accurate determination of the present value of future lease payments. This rate is derived by considering the implicit interest rate, risk-free rate, risk premium, lease term, and periodic payments.

The implicit interest rate reflects the market conditions and the creditworthiness of the lessee. The risk-free rate serves as the foundation for the discount rate, while the risk premium accounts for the lessee's default risk. The lease term and periodic payments impact the calculation due to the time value of money and the associated risks.

By carefully following the steps and incorporating all relevant factors, you can ensure an accurate weighted average discount rate that properly reflects the economic substance of the lease transaction. This, in turn, leads to a faithful representation of the lease liability and right-of-use asset on the balance sheet.

Remember, the calculation of the weighted average discount rate is not merely a technical exercise but a crucial element in ensuring the reliability and transparency of financial statements. By adhering to accounting standards and exercising professional judgment, you contribute to the integrity of the financial reporting process.

How to add discounts on shopify

Does wendys offer senior discounts

Does the ymca offer military discount